Compare motorhome insurance

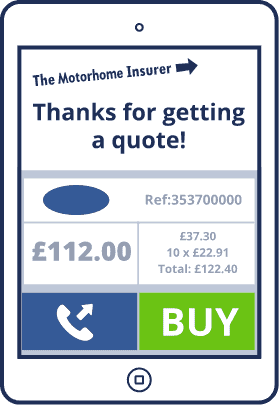

Get quotes and compare prices online or over the phone

See how much you could save! Get a quote in minutes.

How comparison works

You tell us details about yourself and what you’re looking to insure

We provide instant quotes from a panel of top UK insurers

You choose the policy you want, buy it, and job done!

Why compare quotes with us?

What level of cover do I need for a motorhome?

The more you’re out on the road, the greater the chance of being involved in an accident. That’s why a higher annual mileage can increase how much you pay for motorhome insurance.

Finding cheap insurance coverage for your vehicle may be more challenging if you use your campervan for regular commuting and normal living. However, only driving your motorhome when taking trips or at weekends could open you to a range of cheaper insurance policies.

By avoiding making any claims on your policy, you can earn a no-claims discount on your insurance premiums. The discount usually increases with each consecutive year you go without a claim and could make a substantial saving on your annual premium.

Historic or modified motorhomes could be more costly to repair or replace. Modifications may alter your vehicle's performance, handling or safety features, which insurers could see as increasing the risk of accidents or claims.

Being a motorhome or caravanning club member may get you a discount on your insurance premium. You will have to provide the chosen insurer with proof of membership.

The main types of motorhome insurance usage

Social, Domestic and Pleasure (SD&P)

SD&P covers motorhomes solely used for social, domestic, and pleasure purposes, such as family holidays or weekend trips. It does not cover the motorhome for business-related activities, including your daily commute or any commercial use.

Social Including Commuting

Social including commuting coverage is ideal for those who use their motorhome as a mode of transportation to and from one place of work in addition to using it for general social purposes including trips away from home.

Business Use

As well as for social and commuting purposes, business use covers motorhomes used for business or commercial purposes, such as transporting goods or equipment, visiting clients, or journeys beyond just your commute to work.

How to try and reduce the cost of your motorhome insurance quote

What motorhome insurance add-ons can I choose?

Breakdown Cover & Roadside Repairs: This provides assistance if your motorhome breaks down while you're on the road and can cover towing and repairs.

European Cover: This insures your vehicle for any trips outside the UK to Europe, and may include breakdown and emergency assistance abroad too.

Legal Expenses Cover: This may help cover any legal expenses that arise from an accident involving your motorhome.

This covers personal belongings in your motorhome, such as clothing, electronics, and camping equipment.

This covers damage to awnings or other equipment attached to your motorhome, such as satellite dishes or bike racks.

This covers the cost of repairing or replacing your motorhome's windscreen in case it is damaged.

Motorhome insurance FAQs

Yes, to use your motorhome on public roads in the UK you are required to have valid insurance in place.

If your motorhome is found to be uninsured, you could face a fixed penalty notice and points on your driving licence.

In more serious cases, you could be taken to court, fined, and even receive a driving ban. You could also face personal liability for any damages or injuries caused in an accident while driving uninsured.

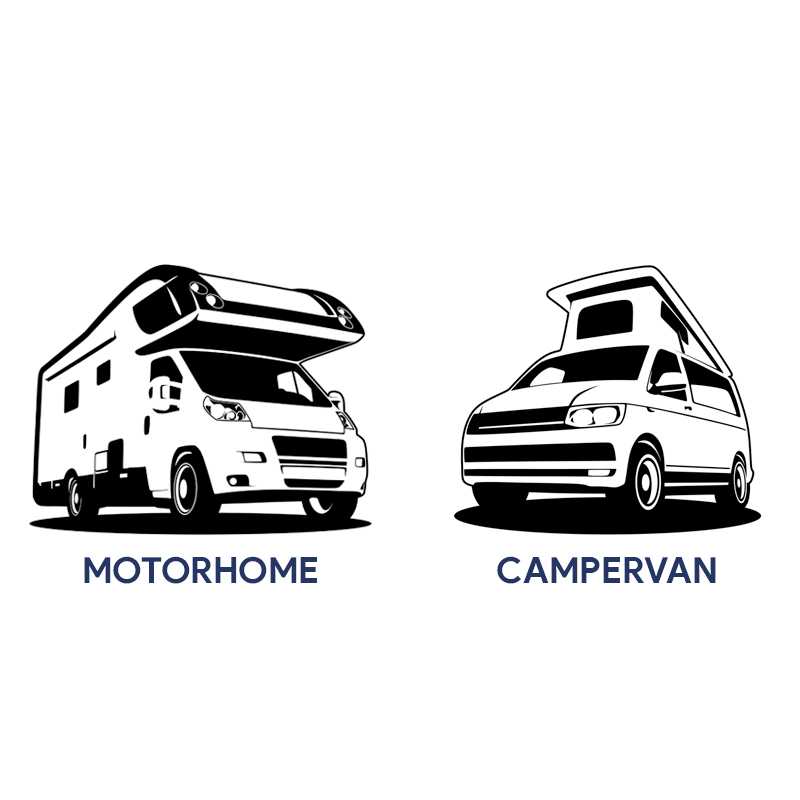

No, you must purchase specialist insurance for your motorhome. Motorhomes are very different to cars and so require proper insurance coverage designed just for them.

Contents insurance covers your personal belongings and any household items that are lost, damaged or stolen from your motorhome.

Assets such as your clothes, furniture, technology (televisions, computers, laptops), kitchen appliances (fridge, cooker), and jewellery (possibly subject to certain limits on value) can be included in this coverage. However, if you own a property and have home insurance, you might be able to combine your contents coverage and home insurance rather than taking out two policies. It’s a good idea to check your cover with your home insurance provider to make sure it meets your needs.

Whether or not you are covered when travelling abroad typically depends on the specific policy you have purchased. Review your policy documents or speak to your insurance provider to understand what coverage is included for trips abroad.

Some motorhome insurance policies may include coverage for international travel, while others may only provide coverage within your home country. The extent of coverage may also vary depending on the destination and length of your trip.

Assess your coverage limits and ensure your policy provides adequate protection for your trip, including third-party liability coverage and coverage for damage to your motorhome.

Usually, yes. Most motorhome policies allow you to add between one to three additional drivers. However, they must meet specific criteria, such as being over the legal driving age and holding a valid, in-date UK driving licence.

It’s important to note that the cost of your insurance may rise when you add additional drivers.

To determine your annual mileage, calculate your weekly driving distance and multiply that by 52. Consider any occasional long trips you make, like summer holidays or road trips: these journeys can accumulate significant mileage even if you only use your motorhome for vacations.

A standard category B licence is sufficient for motorhomes weighing up to 3,500kg.

However, if your motorhome weighs more, you'll need a C1 licence, which requires passing a separate driving test, including a practical and theory test.

If you obtained your licence after January 1997, you should take an additional test to add the C1 category. Remembering that driving regulations may vary when travelling outside the UK is crucial.

You can usually save money on your motorhome insurance by shopping around. Don't settle for the first insurance quote you are given: take the time to compare policies and prices from different insurers to find the best deal for your needs.

Consider raising your voluntary excess to lower your insurance premium. Just remember that you'll need to pay this amount in the event of a claim and so it should be affordable for you.

Or, you could fit your motorhome with security features like an alarm or immobiliser to help reduce the theft risk and potentially lower your insurance premium.

The cost of motorhome insurance can vary depending on several factors, including the type of motorhome you own, your driving history, your age and experience, where you live and what you use the vehicle for.

The best way to get an idea of cost is to compare quotes from different insurers.